➡️See Denise Herich of The Benchmarking Company LIVE in LA.

🌴☀️ Beauty Accelerate is making its LIVE Los Angeles debut March 6-7, 2024 at the Millennium Biltmore hotel, featuring expert talks, networking opportunities, and a boutique exhibition of concept products and services from leading ingredient, packaging and contract/turnkey manufacturing partners. 👉🏽 Register now to set your beauty innovation agenda.

💵DISCOUNT CODE: ATT5

While it’s said that everyone is beautiful in their own way, many U.S. women and men rely on professionals to augment their natural features to enable them to be happier with the skin they’re in.

More than 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures were performed in the U.S. last year, according to the American Society of Plastic Surgeonsa.

Liposuction was noted as the most common surgical cosmetic procedure performed in the U.S. in 2022b, followed by breast augmentation. Of non-surgical procedures, Botox and other neurotoxins topped the list, leading to revenue of $11.8 billion U.S. dollars for all cosmetic procedures that year.

In December 2023, The Benchmarking Company asked more than 4,200 U.S. female beauty consumers which procedures they’ve had, which they’d like to try, as well as their attitudes toward new cosmetic technologies designed to bring about a professional result through non-invasive, in-home product use.

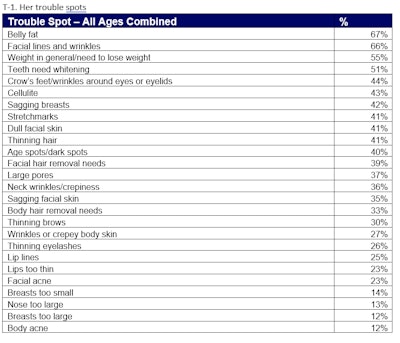

Her 'Trouble Spots'

Skin issues such as cellulite followed (43%), along with sagging breasts (42%), stretchmarks (41%), dull facial skin (41%), age spots/dark spots (40%), large pores (37%), neck crepiness (36%) and sagging facial skin (35%).

Issues surrounding either unwanted hair or hair scarcity were also mentioned, with 41% saying thinning hair was a problem, followed by facial hair removal needs (39%), body hair removal needs (33%), thinning brows (30%) and thinning eyelashes (26%).

While issues surrounding facial acne (23%) and body acne (12%) came out at nearly the bottom of the trouble-spot listing for respondents of all ages combined, for those under 30 years of age, teeth whitening was the number one concern at 68%, followed by belly fat (64%), stretchmarks (55%), weight in general (54%) and facial acne (53%).

Less than 1% of respondents of all ages said they had no areas of their bodies they’d like to improve.

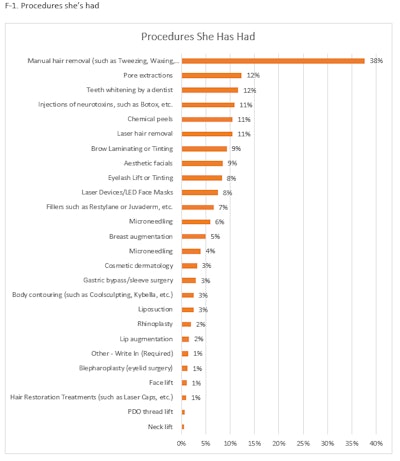

Procedures She Has Had

The most common professional procedure she’s had to combat her trouble spots was hair removal by a professional, with 38% saying they have paid to have this procedure, including tweezing, waxing, dermaplaning, etc., at least once (F-1).

Pore extractions by a dermatologist or aesthetician follow, with 12% saying they’ve had this professional procedure performed on them, followed by teeth whitening by a dentist (12%), Botox or another neurotoxin injection (11%), laser hair removal (11%), chemical peels (11%), brow laminating or tinting (9%), aesthetic facials (9%), eyelash lift or tinting (8%), or using laser devices or LED face masks in a dermatologist office or medispa (8%).

Seven percent have had fillers such as Juvederm or Restylane, and 6% have had a micro-needling procedure.

Breast augmentation topped our respondents' list for cosmetic surgeries, with 5% saying they have experienced it.

Three percent have undergone weight-related surgeries and procedures, including liposuction (3%), gastric bypass or sleeve surgery (3%), and body contouring procedures such as Coolsculping or Kybella (also 3%).

Extending the Benefits

There is an opportunity for brands to position themselves as partners in consumers' professional procedure journey by extending benefits.LIGHTFIELD STUDIOS at Adobe Stock

There is an opportunity for brands to position themselves as partners in consumers' professional procedure journey by extending benefits.LIGHTFIELD STUDIOS at Adobe Stock

There is an opportunity for brands with products of this type to position themselves as partners in her professional procedure journey by maximizing her investment through an extension of benefits.

Brands of products used by respondents to extend or supplement the benefits of professional skin care treatments include Alastin, Bioelements, Dermalogica, Vichy, Obagi, PCA Skin, Skinmedica, Skinceuticals and Zo Skincare, among others.

Teeth whitening strips of various brands were mentioned as follow-ups to a professional whitening service.

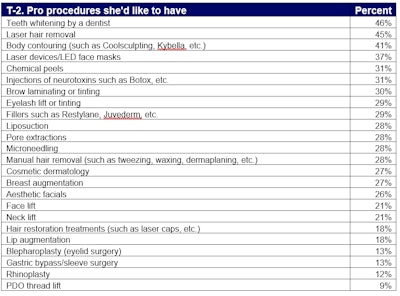

Her Pro Treatment Wish List

What’s Important When Considering a Procedure

When considering a professional cosmetic procedure, 96% of all respondents say the reputation of the professional who would perform the procedure is of paramount importance and a major influencerc, followed by the length of time the benefits will last (95%), possible side effects of the procedure (90%), reviews from other patients who’ve had the procedure (88%), the availability of before and after photos of patients who’ve undergone the procedure (86%), the price of the procedure itself (85%), how quickly she can see the results of the procedure (79%), length of downtime following the procedure (74%), the degree of pain involved (70%), and a convenient location to have the procedure (69%).

The amount of short-term pain involved, as a degree of importance when considering undergoing a procedure, ranked relatively low considering the other rankings, at 70%. When asked what degree of pain she would endure for a procedure that could effectively address her trouble-spot issues, a rating of 6.4, on a scale of 1-10 (with 1 being No Pain at All and 10 being A Great Deal of Pain), was the average.

In-Home, Non-Invasive vs. Professional Procedures

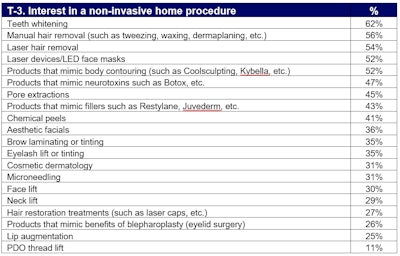

Respondents were asked if, instead of a professional cosmetic procedure, would they be interested in trying a less-invasive solution that they could use at home, themselves, for some trouble-spot issues.

That answer was a resounding yes from 91% of respondents, with 7% saying they weren’t sure and just 2% saying no.

Teeth whitening (62%), manual hair removal (56%), and laser hair removal (54%) topped her list of non-invasive, at-home procedures she’d love to experience if the results were on par with a professional procedure, with healthy interest in others, as shown in T-3.

While interest is high for these types of potential in-home procedures, 86% of respondents expect them to be less expensive than a professional procedure–even if the outcome was the same and the benefits lasted just as long.

Based in sun-seared San Diego, DENISE HERICH is co-founder and managing partner at The Benchmarking Company (www.benchmarkingcompany.com). The Benchmarking Company provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies, focus groups, its annual PinkReport, and consumer beauty product testing for marketing claims.

FOOTNOTES

bhttps://www.statista.com/statistics/281224/leading-surgical-cosmetic-procedures-in-the-united-states/

cWhen asked degree of importance in decision to undergo a procedure, with 1 being Not Important and 5 being Very Important.