Your staff is the lifeblood of your practice. They are the first and last contact your patients have with your facility. They vary in age, gender, experience and definitely in personality. But they may also vary in their work statuses.

What may at first seem like a straightforward categorization of which associates work 40 or more hours each week and which ones work fewer hours is actually more nuanced. The following is a refresher on part-time and full-time rules as well as an introduction to the latest laws.

Defining Part-Time and Full-Time Employment

A good starting point is to simply define part-time versus full-time. As far as the federal government is concerned, there is not a legal definition of part-time employment. The overseeing law is the Fair Labor Standards Act (FLSA), and it does not specifically define this employment status. With no federal definition of part-time status, it is up to the states to set the rules. Most states specify that employees who work less than 35 hours per week—on a consistent basis—are considered part-time. This means if an employee works 40 or more hours every week, but one week only works 10 hours, the employee is still a full-time associate, because that single shorter work week was an anomaly.

There are some definite advantages to having part-time workers; the most obvious is that it keeps labor costs in check, as overtime pay typically does not apply to part-timers. Another benefit is that it is often easier to schedule a part-time associate to fill in gaps in the work schedule. As far as employees are concerned, some prefer part-time status as it permits a greater degree of flexibility in their daily schedules.

Although the definition of part-time status is not spelled out by the federal government, all employees—part-time and full-time—are covered by U.S. laws concerning child labor, safety, work-related injuries, harassment and discrimination. In addition, employees who work more than 1,250 hours in a year are eligible for leave under the Family Medical Leave Act. Your state may also have additional regulations that go beyond what the federal rules mandate.

Take Five

When it comes to breaks for both part-time and full-time employees, there are several things to keep in mind. In California, Colorado, Kentucky, Nevada, Oregon and Washington, employees are entitled to a paid 10-minute break for every four hours worked. For employees in most states, this time is also figured into calculations for overtime pay.

Image copyright iStockphoto.com.

[pagebreak]

Slightly fewer than half the states require a 30-minute unpaid lunch break if employees work a minimum of five or six hours a day. Earlier this year, the California Supreme Court found in favor of employers in how lunch breaks are administered. Prior to the case, states put the onus of keeping employees from working during a lunch break on the employer. The recent court case stipulates that employers do indeed have to provide a meal break, but they do not have to monitor what the employee is doing while on that break.

In Delaware, employees who work a minimum of 7½ hours a day receive a 30-minute unpaid lunch break. Minors in that state get their break after only five hours. There may be additional rules governing minors in your state, so be sure to clarify this with your state’s labor department.

Benefits and Pay

Benefits—such as health care, vision care, dental, vacation, sick time, gym memberships and so on—are often important recruiting tools and have also been shown to increase employee retention. However, there are no federal laws requiring employers to offer those same benefits to part-time workers. Your practice may choose to extend these benefits to your part-timers as a sign of appreciation for their efforts, but it is not a federal requirement. The only exception is if your practice provides a retirement or pension plan. The Employee Retirement Income Security Act dictates that if an employee works 1,000 or more hours in a calendar year, that employee should be offered the same pension plan that full-time employees receive. Otherwise, it is entirely up to you which benefits you provide to part-time associates.

Typically, part-timers are paid on an hourly basis and are not eligible for overtime pay. However, part-time employees in certain states—such as Alaska, California and Colorado—may be entitled to overtime pay if they work more than a certain number of hours in a single day, even if they work only one day a week.

[pagebreak]

In order to ensure that you are respecting state and federal laws, excellent recordkeeping is a must (see "FLSA Recordkeeping" on page 26 for the minimum requirements). Maintain your documentation in a central location. The FLSA requires that you keep these records up to date, and the Department of Labor is the entity that oversees documentation compliance. Because labor laws vary from state to state, it is recommended that you contact your local labor department or a labor attorney for compliance issues.

Steven Austin Stovall, PhD, is professor of management at Wilmington College in Wilmington, OH. Contact him at [email protected].

[pagebreak]

Websites of State Labor Departments

Alabama alalabor.state.al.us

Alaska labor.state.ak.us

Arizona ica.state.az.us

Arkansas arkansas.gov/labor

California dir.ca.gov/dlse/

Colorado coworkforce.com

Connecticut ct.gov/dol

Delaware delawareworks.com

District of Columbia does.dc.gov

Florida floridajobs.org

Georgia dol.state.ga.us

Hawaii hawaii.gov/labor/

Idaho labor.idaho.gov

Illinois state.il.us/agency/idol

Indiana in.gov/labor

Iowa iowaworkforce.org/labor

Kansas dol.ks.gov

Kentucky labor.ky.gov

Louisiana laworks.net

Maine state.me.us/labor

Maryland dllr.state.md.us

Massachusetts mass.gov/eolwd

Michigan michigan.gov/lara

Minnesota doli.state.mn.us

Mississippi mdes.ms.gov

Missouri labor.mo.gov

Montana dli.mt.gov

Nebraska dol.nebraska.gov

Nevada laborcommissioner.com

New Hampshire nh.gov/labor/

New Jersey lwd.dol.state.nj.us/

New Mexico dws.state.nm.us

New York labor.state.ny.us

North Carolina nclabor.com

North Dakota nd.gov/labor

Ohio com.state.oh.us

Oklahoma ok.gov/odol/

Oregon oregon.gov/boli

Pennsylvania dli.state.pa.us

Rhode Island dlt.ri.gov

South Carolina llr.state.sc.us

South Dakota sd.gov/

Tennessee state.tn.us/labor-wfd

Texas twc.state.tx.us

Utah laborcommission.utah.gov

Vermont labor.vermont.gov

Virginia doli.virginia.gov

Washington lni.wa.gov

West Virginia wvlabor.com/newwebsite/pages/index.html

Wisconsin dwd.state.wi.us

Wyoming wyomingworkforce.org/pages/default.aspx

Guam dol.guam.gov

Puerto Rico dtrh.gobierno.pr

Virgin Islands vidol.gov

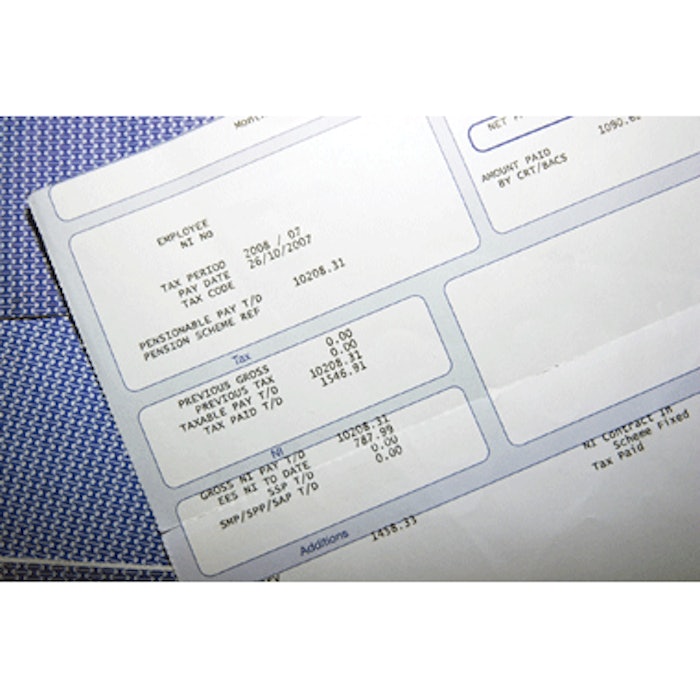

FLSA Recordkeeping

Following are the minimum recordkeeping requirements per the Fair Labor Standards Act (FLSA), administered by the U.S. Department of Labor.

Personal information, including employee’s name, home address, occupation, sex and birth date if under 19 years of age

Hour and day when workweek begins

Total hours worked each workday and each workweek

Total daily or weekly straight-time earnings

Regular hourly pay rate for any week when overtime is worked

Total overtime pay for the workweek

Deductions from or additions to wages

Total wages paid each pay period

Date of payment and pay period covered