With the rapid innovation in aesthetic devices, injectables and other aesthetic treatments, techniques and trends this year, the treatment options for patients across generations, ethnicities and gender have evolved and grown at an astounding rate. More options also means changing preferences in patients' treatment choices to suit their particular aesthetic concerns, so we want to keep our finger on the pulse of how these changes have impacted the growth of certain treatments in your medspa or aesthetic practice. Have you noticed a particular treatment type that has increased in demand this year at your medspa or practice?

In our recent survey which asked, Which of the following treatments have grown the most at your medspa or practice so far this year: A) Injectable treatments, B) Energy-Based treatments OR C) Skin care services (facials, peels, etc.)? 21% of readers said Injectable treatments, 36% said Energy-Based treatments and 43% said Skin care services.

Top 3 Growing Treatment Categories in 2024 & Their Future Market Projections

To stay competitive in this ever-evolving global landscape of aesthetic treatments and rapid innovation shaping treatment preferences and trends, understanding where the market for these different categories of procedures is heading is paramount. Here are three market breakdowns of where the demand for these treatments in the aesthetics industry is headed in the months and years to come.

1. Injectables

While this ranked 3rd amongst the treatments experiencing the most growth in aesthetic businesses in 2024, market reports suggest they still reign supreme among treatments driving the highest demand among clients seeking professional services in the industry. Injectable treatments, such as neurotoxins and dermal fillers, are the most popular minimally invasive procedures in the medical aesthetics industry and the most common minimally invasive procedures in the aesthetic industry. According to recent data, the demand for facial injectables is expected to grow at a CAGR of 10.6% from 2020 to 2027.

Interestingly, while Gen Z has been getting the most attention in the past few years for their interest in injectable treatments, it seems that Millennials are the ones currently driving the demand for injectable treatments in medical aesthetics.

When it comes to which injectables are battling it out for supremacy, neurotoxins take 1st place, with neurotoxin injections being the most popular non-surgical aesthetic procedure in the U.S. Dermal fillers are a close 2nd, however, with the global market for dermal fillers expected to reach $10.5 billion by 2026. In particular, hyaluronic acid-based dermal fillers account for over 95% of the global market share. However, it is combination treatments that use neurotoxins and dermal fillers together that industry professionals should pay most attention to when it comes to the services patients are growing increasingly interested in moving forward. With the face contituting the battleground for medical aesthetics supremacy in the U.S. market, keeping an eye on the growing demand for combination injectable treatments is the key to success with injectable treatment growth in aesthetic practices and medspas.

2. Energy-Based Treatments

While energy-based devices came in 2nd in our survey, this is one area you don't want to take your eyes off. Recent reports state that the global market for energy-based devices in medical aesthetics is anticipated to reach $7.4 billion by 2026 and the market for beauty devices is projected to reach $11.6 billion by next year.

Breaking this down a bit further, laser hair removal is actually one of the most popular non-invasive aesthetic procedures globally. Skin resurfacing and rejuvenation treatments are also expected to rise substantially. The market for laser skin resurfacing procedures is estimated to reach $2.6 billion by 2027, while the market for radiofrequency devices is projected to exceed $14 billion by 2026 and non-invasive skin tightening procedures is expected to reach $1.5 billion by next year.

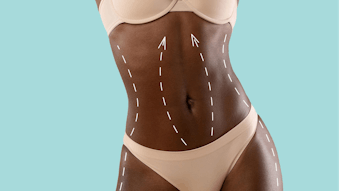

Body sculpting and contouring are most definitely skyrocketing in demand, a market trend in line with the emergence of GLP-1 treatments for weight loss. The non-surgical fat reduction procedures market is expected to exceed $2.5 billion by 2025, non-invasive body contouring procedures are expected to grow at a CAGR of 16.4% from 2020 to 2027 and the body sculpting procedures market is expected to grow at a CAGR of 17.3% from 2021 to 2028.

3. Skin Care Services

The world is uniting in the pursuit of the perfect skin care routine and treatments to achieve flawless, glowing skin without going under the knife, resulting in the demand for non-surgical cosmetic procedures like chemical peels skyrocketting globally. Chemical peels are one of the top five non-surgical aesthetic procedures in the U.S., and the demand for these skin resurfacing and rejuvenation non-surgical skin care services is rising globally. Tied to these skin care services is the use of skin care products that enhance and maintain this quest for radiant, flawless skin. The number of skincare products linked to cosmetic surgery procedures has increased by 35% in recent years and the global skin care market is expected to reach $183.03 billion by next year. Consumer knowledge of the damaging effects our own environment and pollution on our skin health is also rising significantly, with sales of anti-pollution skin care products projected to reach $19.2 billion by 2027.

Sources:

1. https://worldmetrics.org/cosmetic-surgery-industry-statistics/

2. https://worldmetrics.org/personal-products-industry-statistics/

3. https://worldmetrics.org/personal-care-industry-statistics/

4. https://worldmetrics.org/medical-aesthetics-industry-statistics/

Check back every week for a new one-click survey.

We'll reveal the answers in next week's MedEsthetics newsletter.