Weight loss has taken center stage on Wall Street, after the mega successes of Novo Nordisk’s Ozempic and Eli Lilly’s Mounjaro. In 2023, Ozempic and obesity formulation Wegovy, generated a whopping $18.4 billion for Novo Nordisk, or over half of the company’s total revenue. Eli Lilly’s newer drugs Mounjaro and Zepbound brought in $5.2 billion in total. Wall Street analysts are projecting even greater sales from these weight loss treatments in 2024, which is drawing investor interest to the aesthetics and weight loss market.

The Issue: Loss of Lean Muscle Mass

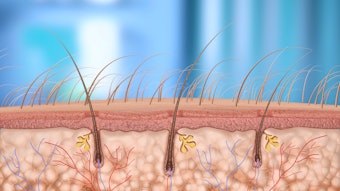

Despite the growing popularity of weight loss treatments, there is a significant concern that has remained largely unaddressed until now: the loss of lean muscle mass. It's becoming well-known that GLP-1 therapies for weight loss can lead to the loss of lean muscle mass. In fact, past studies have shown that approximately 40% of the weight loss achieved with GLP-1 therapies can be attributed to the loss of muscle mass rather than fat. This is a concern because losing muscle mass can have negative consequences for overall health, metabolism and even aesthetics. Patients experience the “skinny fat” look, loose skin and stretch marks.

Solutions in the Pipeline

To get a piece of the sheer money flying around in this weight loss frenzy, drug companies are pivoting and trying different solutions to help address the muscle loss dilemma. One approach is to combine GLP-1 therapies with other medications that help preserve muscle mass. For example, Eli Lilly, now the largest pharmaceutical company in the world thanks to weight loss, made a $1.9 billion dollar acquisition of Versanis, a startup working on combining GLP-1s with a treatment that targets myostatin and activin, both proteins associated with muscle regulation.

Other publicly traded startups have followed suit to explore treatments to preserve muscle mass while on GLP-1 weight loss treatments. Keros Therapeutics raised $140 million dollars. Scholar Rock raised $80 million. For Veru Pharma, the amount was $35 million. All companies are in early stages working on different approaches to this problem, but they share the same goal: to show that people can lose weight while preserving muscle mass.

Early Innings of Next-Generation Weight Loss Treatments

The development of treatments that address the muscle loss dilemma presents a compelling investment opportunity because of just how large the market is. In the US, more than 2 in 5 adults (42.4%) have obesity. As a result, there are expected to be many players vying for this market. Eli Lilly, with their acquisition of Versanis, has the first-mover advantage in the obesity – muscle preservation combination approach. However, that does not necessarily mean that they will have the best drug. It is still early in this muscle preservation approach, with the majority of treatments in early-stage clinical trials.

To prove to be superior to the first generation of weight loss drugs, like the blockbusters from Novo Nordisk and Eli Lilly, these newer versions must address existing limitations, mainly tolerability in form of fewer gastrointestinal side effects and preserved muscle loss. For now, biotechnology companies and the investment community have focused on the latter.

The muscle loss dilemma in weight loss treatments is a significant concern, but it's also a promising area of innovation. Weight loss and aesthetics are at the top of investors’ minds, and with the right investment, it’s possible to support the development of treatments that help people achieve their weight loss goals while preserving their muscle mass and overall health. There is money in looking good and feeling good, and Wall Street has caught on the trend.